Understanding the balance between your financial commitments and your cash flow requirements will help us to evaluate scenarios most suited for maintaining your lifestyle before and after retirement.

Our Personal CFO platform uses cutting edge technology to aggregate all your assets, liabilities, income, and expenses in one place, in real time. We then organize your most important documents into your digital vault, so you never have to search for that crucial piece of paper again. Utilizing that same technology, we can identify where your dollars might be better spent and determine the most effective way to prioritize your spending to saving ratio. Through our quarterly review process, we will collaboratively create the discipline needed to help achieve your most important life goals.

Retirement Planning

We help our clients with answers to the essential questions that can impact their income and spending when working towards their immediate and long-term goals.

- Are you saving enough for retirement?

- Do you know what to expect for retirement income?

- Wondering when the best time is to collect social security or a pension?

- Will you have enough money in retirement to travel, pursue hobbies, or pursue another career?

- Can you retire early?

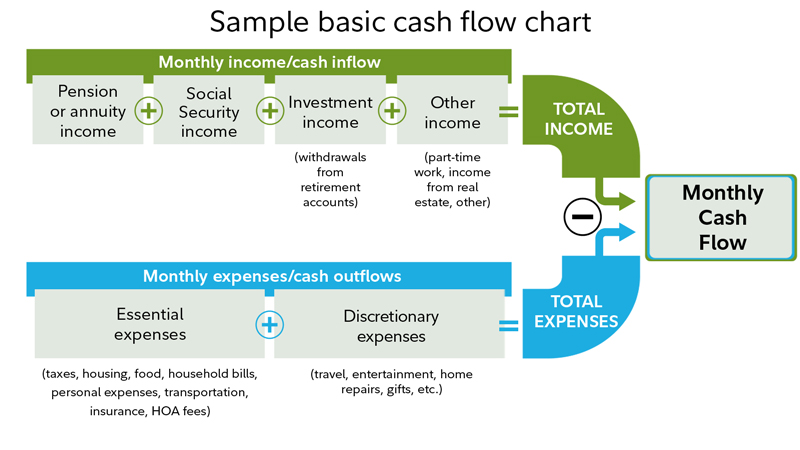

Cash flow planning

Cash Flow Planning is the process of creating a sensible strategy for funding your retirement that balances current financial needs with expected needs many years into the future. By comparing your assets to your expenses over time, we can identify periods when you may fall short and when you may come out ahead.